The Co-operative Credit Union

Easy ways to save and affordable loans from your Co-operative Credit Union.

Credit unions are not for profit organisations which are owned and controlled by members, with no outside shareholders to satisfy. Members save regularly every month, and this forms a pool of money which is lent to members by way of loans at reasonable rates of interest.

Members can get involved as much or as little as they like – from simply saving and borrowing to attending the Annual General Meeting where members elect Directors and vote on the share dividend or even becoming actively involved as volunteers.

Join a credit union and you become part of a huge worldwide movement. Across the world there are 57,000 credit unions, operating in 103 countries in 6 continents, serving 208 million people. In total these credit unions hold $1.4 Trillion in Savings and $1.1 Trillion in Loans.

Joining The Co-operative Credit Union brings many benefits to members:

1. The Co-operative Credit Union provides an easy way to save, from a little as £10 per month and these regular amounts soon build up.

2. You can change the amount you save and withdraw money easily too – just e-mail us at [email protected].

3. Your savings are safe – Credit Unions are regulated by the Financial Conduct Authority and the Prudential Regulation Authority, just like banks and building societies. Members’ savings are protected by the Financial Services Compensation Scheme (FSCS).

4. Depending on reserves, shares (savings) are eligible for an annual dividend.

5. As we are a ‘not for profit’ financial co-operative, our surplus profit is returned to members via the annual dividend.

6. We are an ethical savings choice.

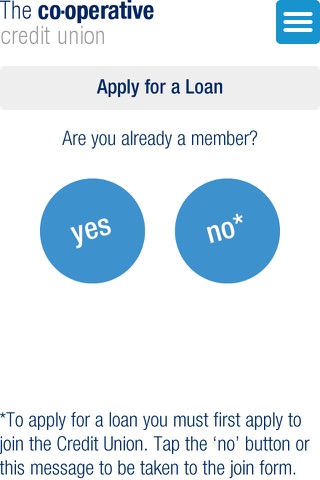

7. We provide affordable loans for members at very competitive rates of interest. Starter loans are available for new members and existing members can apply for loans based on the amount they have in their share (savings) account.

8. There are no hidden charges or fees on any transactions and no early settlement fees.

9. Part of what makes the credit union unique is our free Loan Protection Insurance offered at no cost to members. Should a member die, any outstanding loan is settled in full.

10. The credit union is owned by members and run for the benefit of members – so you share in our success.

The Co-operative Credit Union is open to current employees and pensioners of a range of co-operative organisations. Family members of employees can also join provided that they are living at the same address and over the age of 16.